Cracking Down on Identity Theft: How SIM-Based Verification is a Game Changer

Oct 30, 2024

Introduction

Imagine a world where your identity is for sale to the highest bidder. Where a criminal can impersonate you, drain your bank accounts, and erase your digital footprint with just a few clicks. This is not a dystopian future; this is the reality of the identity theft black market today.

Identity theft is not just an isolated crime affecting individuals; it's a vast, organized operation, feeding into a black market worth billions of dollars globally. In a digital world, stolen identities fuel fraud, money laundering, and financial theft at unprecedented scales.

This article unveils the scope of the identity theft black market and introduces a cutting-edge solution from SLC: SIM-based identity verification technology designed to safeguard against fraud and protect user identities at the source.

The Scope of Identity Theft on the Black Market

Identity theft is one of the largest and fastest-growing crimes, with estimates suggesting it costs the global economy more than $5 trillion annually [1]. Black market websites sell stolen identities for as little as a few dollars, contributing to the financial losses faced by businesses, individuals, and governments alike [2].

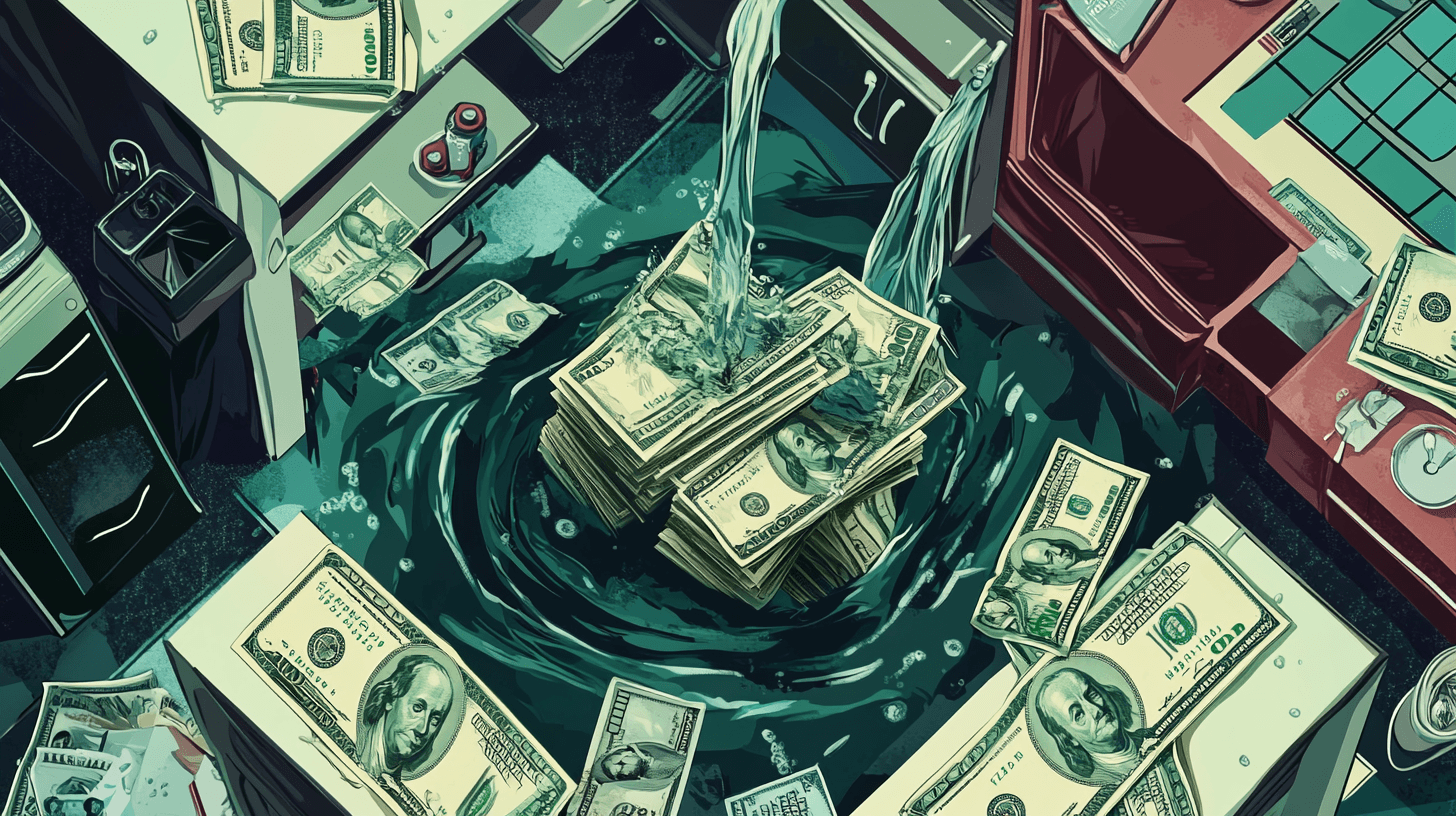

These stolen identities are the backbone of various criminal activities:

Money Laundering: Stolen identities enable criminals to move funds through legitimate banking systems without detection.

Fraud: From credit card fraud to synthetic identity fraud, stolen identities are the foundation of these schemes.

Human Trafficking & Terrorism Financing: Stolen identities are used to shield these illicit activities, making them harder to trace.

The Rise of Digital Identity Theft

As more services migrate online, personal information is increasingly exposed to vulnerabilities. Hackers target databases, social media accounts, and mobile devices. Many traditional verification systems (passwords, 2FA, etc.) can be breached, often by social engineering or phishing attacks [3].

High-profile data breaches have become a major driver of the identity theft black market. One of the most notorious examples is the 2017 Equifax breach, which exposed the sensitive personal information of nearly 148 million Americans [4].

The breach occurred when hackers exploited a vulnerability in Equifax's website application, allowing them to access a vast trove of data, including names, Social Security numbers, birth dates, addresses, and driver's license numbers. In some cases, even credit card numbers and dispute documents containing personal information were compromised.

The impact of the Equifax breach was staggering. The stolen data quickly found its way onto the dark web, with cybercriminals offering it for sale in various underground marketplaces. According to a report by security firm Bitglass, the personal information of nearly 150 million Equifax breach victims was available on the dark web within just two weeks of the breach being disclosed.

The consequences for individuals affected by the breach have been severe. With their personal information in the hands of cybercriminals, these individuals face an increased risk of identity theft, fraudulent credit applications, and other financial crimes. The U.S. Department of Justice estimates that identity theft victims lose an average of $1,343 per incident, with the total cost of identity theft in the United States exceeding $15 billion annually [5].

For Equifax itself, the breach has had significant legal and financial repercussions. The company faced multiple lawsuits, congressional hearings, and investigations by federal and state authorities. In 2019, Equifax agreed to pay up to $700 million to settle with the U.S. Federal Trade Commission, the Consumer Financial Protection Bureau, and 50 U.S. states and territories over the breach [6].

The Equifax breach is just one example of how high-profile data breaches can fuel the identity theft black market.

Introducing SIM-Based Identity Verification Technology

SIM-based verification ties the identity of the user to their SIM card, which is linked to a verified mobile number and account. This makes it much harder for criminals to impersonate or steal identities without physical access to a device.

Compared to traditional systems, SIM-based verification offers several advantages:

Security: SIM-based verification is more secure than SMS-based 2FA, which can be compromised by SIM-swapping or interception.

Accessibility: Almost everyone globally has access to a SIM-enabled mobile device, making this solution scalable even in regions where traditional forms of verification (like credit bureaus) are lacking.

Countries like India, with its Aadhaar-linked SIM registration, have already seen success in curbing identity theft through similar methods.

SLC: Filling the Gaps in Global Identity Protection

SLC's technology provides real-time verification, ensuring that transactions (financial or otherwise) are executed by authenticated parties. It offers businesses, financial institutions, and governments a proactive way to prevent fraud before it occurs, reducing reliance on post-incident recovery.

While other solutions focus on patching up breaches after they occur, SLC's SIM-based verification pre-empts the issue, ensuring that only verified users are allowed access in real-time. This is crucial for industries where identity is the key to security (financial services, healthcare, government).

The Future of Identity Security: Global Adoption of SIM-Based Verification

The explosive growth of mobile adoption in emerging markets creates an unprecedented opportunity for SIM-based verification to become the global standard for identity protection. Consider these compelling trends:

By 2025, global smartphone adoption is projected to reach 1.23 billion units, with emerging markets driving significant growth. The mobile-first approach is becoming dominant, with predictions suggesting that 72% of internet users will exclusively use mobile devices to access the internet by 2025 [7].

In Sub-Saharan Africa alone, unique mobile subscribers have reached 475.8 million, representing a 43% penetration rate, with mobile internet users accounting for 271.1 million people. This mobile ecosystem contributes over $170 billion to the region's GDP, demonstrating both its economic importance and widespread adoption [8].

The Asia-Pacific region, which already holds 57.68% of the flexible printed circuits market share, continues to see rapid smartphone adoption with over 100 million new users added in 2023. This growth trajectory shows no signs of slowing, particularly in emerging economies like India and Southeast Asian nations [9].

This widespread mobile adoption creates the perfect foundation for SLC's technology, which can integrate with blockchain, biometrics, and AI-driven fraud detection systems to offer multi-layered security. As these emerging markets leapfrog traditional banking and identification systems, SIM-based verification becomes not just an option but a necessity for secure digital transformation.

Conclusion

The black market for stolen identities will continue to thrive unless we adopt more secure, proactive solutions. SLC's SIM-based verification technology offers a transformative approach to identity protection, drastically reducing the risks of fraud, money laundering, and theft in today's connected world.

In a world where our identities are increasingly digital, safeguarding them is not just a matter of personal security, but of global economic stability. It's time for policymakers and organizations to take a stand and embrace the future of identity verification. With SLC's cutting-edge solution, we can turn the tide against the identity theft black market and create a safer, more secure world for all.

References

2024 Global Cost of Fraud report by the Association of Certified Fraud Examiners (ACFE). https://www.acfe.com/-/media/files/ACFE/PDFs/RTTN/2024/Infographics/The-Global-Cost-of-Fraud.pdf

Your Social Security Number Costs $4 On The Dark Web. https://www.forbes.com/sites/jessedamiani/2020/03/25/your-social-security-number-costs-4-on-the-dark-web-new-report-finds/

Balbix. https://www.balbix.com/insights/attack-vectors-and-breach-methods/

Harvard Business School. https://www.hbs.edu/faculty/Pages/item.aspx?num=53509

Bureau of Justice Statistics' 2018 “Identity Theft Victimization Report. https://bjs.ojp.gov/library/publications/victims-identity-theft-2018

Federal Trade Commission. (2019). The Equifax Data Breach. https://www.ftc.gov/news-events/news/press-releases/2019/07/equifax-pay-575-million-part-settlement-ftc-cfpb-states-related-2017-data-breach

Worldwide Smartphone Forecast Update, 2024–2028. https://www.idc.com/getdoc.jsp?containerId=US52314824&pageType=PRINTFRIENDLY

[8] GSMA. "The Mobile Economy Sub-Saharan Africa 2023". https://www.gsma.com/mobileeconomy/sub-saharan-africa/

Astute Analytica. https://www.astuteanalytica.com/industry-report/fpc-for-smartphone-market